The Global Trade Research Institute highlights opportunities for India’s e-commerce sector following US tariffs on Chinese goods, urging reforms for small exporters.

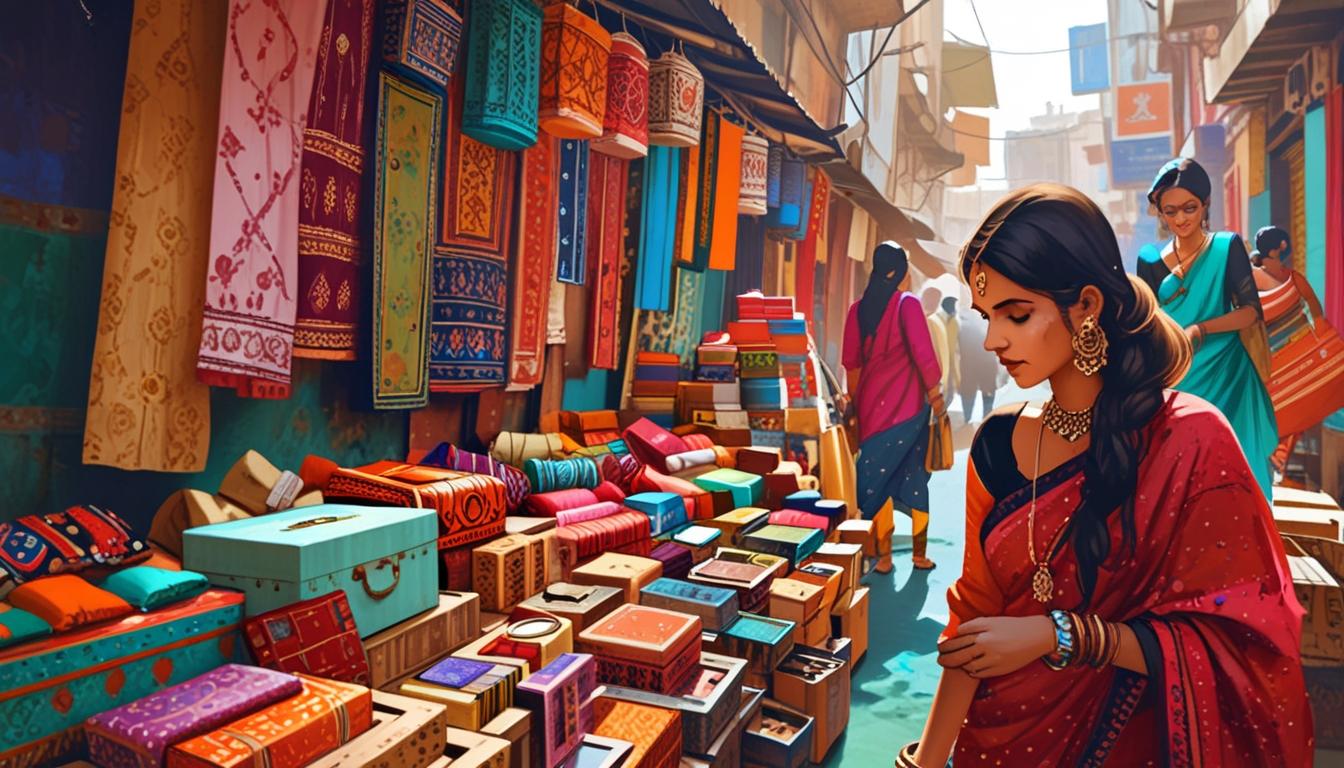

The Global Trade Research Institute (GTRI) released a report indicating that India’s e-commerce sector is presented with a significant opportunity following the United States’ crackdown on low-value Chinese e-commerce shipments. With over 100,000 e-commerce sellers and current exports valued at USD 5 billion, India is in a favorable position to fill the market gap left by China, especially in the areas of customized, small-batch products including handicrafts, fashion, and home goods.

The report, released on April 13, 2023, in New Delhi, highlights the potential for Indian exporters to benefit from the recent executive orders signed by U.S. President Donald Trump. On April 2, Trump removed the de minimis exemption for imports from China and Hong Kong, which previously allowed packages valued up to USD 800 to enter the U.S. without incurring duties. This change particularly affected companies like Amazon, Shein, and Temu, which had thrived under the old rule. Trump followed up with an April 9 executive order raising tariffs on e-commerce goods from China.

To fully exploit this opportunity, the GTRI report suggests that India must implement urgent reforms tailored to the needs of its small online sellers. The current trade system in India primarily supports large, traditional exporters, posing challenges for smaller e-commerce players who often find the bureaucratic red tape overwhelming.

A primary concern highlighted in the report is the banking system in India. The report indicates that Indian banks present a significant hurdle for e-commerce exports due to their inability to handle the high volume and small-value nature of these transactions. For instance, existing Reserve Bank of India (RBI) regulations stipulate a mere 25 percent variance allowed between declared shipping values and final payments, a constraint that does not accommodate returns, discounts, and platform fees typically involved in online sales. The report recommends increasing this limit to 100 percent in order to give banks more flexibility in approving legitimate cases of payment divergence.

The report underscores additional issues surrounding bank fees, which can significantly diminish the profitability of small exports. For each small shipment, exporters may incur costs ranging from Rs 1,500 to Rs 2,000, which can be nearly half of the shipment’s value. Suggestions include waiving these fees for low-value exports and fully digitizing the banking processes to streamline operations. Establishing strict service timelines and grievance mechanisms with the RBI could further assist exporters.

Additionally, the customs system in India is indicated to require modernization, with a recommendation for online operations that provide automated inspections and user-friendly digital checklists for small exporters. It’s also noted that shipment terms like “Delivered Duty Paid (DDP)” need updating to align paperwork with logistics, thereby avoiding avoidable delays in the shipping process.

Finally, the report advocates for enhanced access to credit for small online sellers, who are currently disadvantaged compared to larger players. While larger businesses can obtain loans at interest rates of 7-10 percent and benefit from purchase-order-based financing, smaller sellers are often forced to pay between 12-15 percent and are excluded from public credit programs. Inclusion in priority sector lending programs could help to level the competitive landscape.

Furthermore, the report suggests extending incentives for exporters, such as the advance authorization scheme, the Remission of Duties and Taxes on Exported Products (RoDTEP), and duty drawbacks to further support the burgeoning e-commerce sector in India.

Source: Noah Wire Services

With thanks! Ample facts.

casino en ligne France

You’ve made the point.

casino en ligne

You revealed that effectively!

casino en ligne France

Wonderful postings, Kudos.

casino en ligne France

Fantastic content. Thank you!

meilleur casino en ligne

Really plenty of helpful knowledge!

casino en ligne France

Thank you! Quite a lot of tips!

casino en ligne

Thanks a lot. Useful information.

casino en ligne francais

Wow plenty of excellent information!

meilleur casino en ligne

Many thanks! Plenty of advice!

meilleur casino en ligne