Boohoo Group announces a rebranding of Debenhams, transitioning it into a marketplace model amid challenges faced by its fast-fashion brands.

Boohoo Group has announced a significant rebranding of the once-popular department store Debenhams, which it acquired in 2022 after the brand’s previous struggles led to its administration. At a presentation held this morning, Boohoo Group CEO Dan Finley expressed optimism about the revitalization of Debenhams, declaring it “Britain’s leading online department store” with a new marketplace model designed for growth.

This strategy shifts Debenhams from a traditional bricks-and-mortar operation to an online platform that allows external brands to manage their own stock and logistics. Finley emphasized that “we are principally a marketplace model… the responsibility for buying, storing, picking, and packing the products rests with our partner.” This “stock-lite” approach aims to minimize risk and capital investment, providing advantages in the competitive and rapidly changing e-commerce landscape.

Since embracing this model, Boohoo has reported impressive performance metrics, including a gross merchandise value (GMV) reaching £645 million in fiscal year 2025, a 43% increase from the previous year, along with a 27% EBITDA margin. Peel Hunt analyst John Stevenson recognized these achievements, citing the effectiveness of the marketplace transition and its potential for further growth, stating, “The momentum is undeniable, and it’s clear that as more brands join the platform, it will keep gaining traction.”

Future initiatives are being developed, including retail media and a financial services platform named Debenhams Pay, which are expected to enhance customer engagement. As Finley noted, the overarching aim is to create a multi-billion-pound GMV business by constructing an ecosystem of brands, partners, and technology that responds to evolving consumer demands.

Despite the optimistic outlook for Debenhams, Boohoo’s core fast-fashion brands—Boohoo, PrettyLittleThing, and Boohoo Man—continue to grapple with declining performance. A growing number of consumers are shifting their preferences, making it increasingly difficult for these brands to capture attention. Stevenson pointed out that demand for fast fashion has softened, with young consumers becoming more discerning about their purchasing decisions. He noted, “The young fashion market has really struggled,” indicating that the sector has taken a hit, particularly with a 25% decline in performance over recent months.

The challenges are compounded by economic factors such as inflation and tightening budgets, driving retailers to rely heavily on discounts, which in turn reduces profit margins. The fierce competition in the market, particularly from competitor Shein, which offers a broader range of low-priced options, necessitates that Boohoo and its brands adapt swiftly to remain relevant.

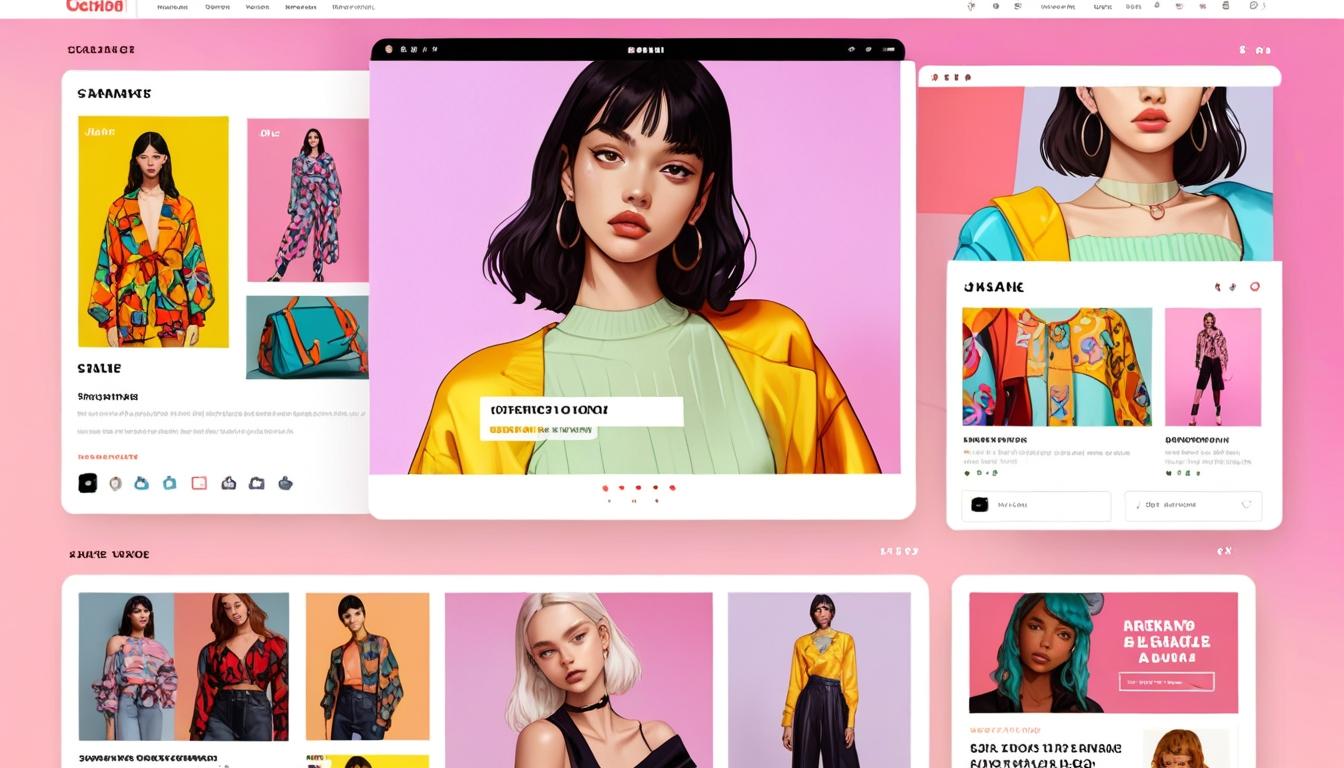

In response to these changes, PrettyLittleThing recently initiated a rebranding effort, transitioning from its distinctive visuals to a more subdued “quiet luxury” aesthetic. However, this shift has received criticism for failing to align with the expectations of its core audience, leading to a negative perception among consumers who now have other low-cost alternatives.

As Chloe Collins, head of apparel at GlobalData, observed, there appears to be a disconnect between the new branding and what consumers expect from the brand. She noted that many young consumers still gravitate toward trend-led styles, which could lead them to explore alternatives like Shein.

The successful adaptation of Debenhams’ marketplace model poses the question of whether similar strategies can revitalize Boohoo’s struggling fashion brands. Stevenson cautioned that simply applying the marketplace model to the fast-fashion segment may not solve deeper issues of relevance and competition, stating, “The shift to a marketplace model won’t automatically resolve the challenges Boohoo’s brands face.”

As Boohoo Group aims to leverage technology and scale its strategy, it must navigate the changing dynamics of its youth fashion brands, which will require thoughtful structural and operational transformations. The long-term success of Boohoo’s rebranding efforts hinges not merely on new models but also on adapting to shifting consumer preferences and market dynamics in a landscape that is becoming increasingly competitive and price-sensitive.

Source: Noah Wire Services

I believe this internet site holds very fantastic written subject material blog posts.